Referrer Hub

We’re your go-to partner for fast, simple, & flexible asset finance for both consumer & commercial clients

We're award winning asset finance brokers based in Melbourne and help clients all over Australia with their asset, vehicle and equipment finance. We're experts in finding easy and flexible finance loans for both consumer and commercial clients.

We’re more than just a referral partner

Trusted Asset Finance Specialists

We provide quick, easy, and flexible asset finance for both consumer and commercial clients. We’re good at what we do, we’ve won lots of awards to prove it! Here’s why you should choose us as a referral partner:

We serve as an extension of your business or network, handling all aspects of asset finance saving you the hassle and cost of hiring a broker in-house for writing loans for assets, equipment, or vehicles.

Our partnership ensures that you don’t have to turn away clients if you don’t offer specific financing services. This prevents your clients from seeking help from other brokers or financial institutions, keeping them within our trusted network.

Our approach is built on the principle of partnership. You focus on your strengths, we handle ours, and together we manage client relationships effectively, always working in their best interests.

Complimentary Car Sourcing Service

We established a dedicated car sourcing department in our business because we strongly dislike not converting leads or losing them to dealerships. Even more so, it’s frustrating when our clients don't secure the pricing, rates, and loan terms they deserve.

This service is designed to ensure that no opportunity is missed. We aim to make the car buying process as easy and stress-free. If a client can't get the car they initially wanted due to stock issues or other reasons, don't worry—we've got it covered. We'll find them a similar, or even better, vehicle that they'll love even more!

Here’s what our free car sourcing service offers:

Fleet and wholesale pricing: We use our wide network to access lower prices on new or used vehicles.

Time & money savings: We do all the work of finding and negotiating, so clients don’t have to.

Full-service experience: From searching to paperwork, we manage the entire car buying process.

Expert advice: Our team provides advice and guidance on choosing the best car and financing options.

Tailored solutions: We find cars that fit the clients’ specific needs and budget.

Best trade-in deals: We also handle the trade-ins of clients' old vehicles, ensuring they get the best possible trade-in price.

Personalised 1:1 Asset Finance Sessions

We provide personalised sessions for both individual brokers and larger teams to explain asset finance. We cover our services, different client and loan types, as well as current rates and terms.

Asset finance can be complex, with each client having unique financial requirements, goals, and varied credit histories. To make these concepts clearer, we discuss real-life case studies in detail and walk through different client scenarios. This approach helps illustrate how we can support you in managing your clients' needs effectively.

Additionally, we offer the "Nurture Program" which is designed to help you better manage and grow your relationships with your ABN holder clients by providing targeted, strategic support. This program focuses on working closely with you to:

Select your top 10 self-employed clients.

Schedule initial contact and introductions.

Develop an Equipment Financing plan for the next 12-24 months.

Order vehicles and arrange credit limits.

Settle accounts and draw down funds proactively.

Benefits of the Nurture Program:

Gain more control over the sales cycle for equipment financing.

Partner with us to enhance client relationships.

Strengthen your business and expand your service offerings.

Establish multiple communication channels.

Conduct regular reviews to stay updated with clients’ needs.

FAQs

-

Our clients include a diverse range of individuals such as PAYG and ABN holders, directors, and small business owners, as well as franchise owners and CFOs, all in need of financing for various types of assets.

-

We accept all deals that require financing for personal or business assets. More information about our services can be found on our website.

-

No, we specialise in asset finance only. Most of our referral network consists of mortgage brokers to whom we refer our clients back to for mortgage needs. If you're not a mortgage broker, we can provide a list of trusted mortgage brokers in our network who can assist with home loans and refinancing.

-

Yes, we offer a referral fee for every lead you send our way that results in a settled deal. Please contact our Partnerships Manager at Leah@hamerfinance.com.au for more information.

-

In addition to our referral fees, we provide our referral partners and their immediate family with the special benefit of processing loans at cost price, without any commission. This is our way of expressing gratitude and offering added value to those who work closely with us.

Additionally, we offer a range of incentives to acknowledge partners who consistently deliver a high volume of leads:

Gift Vouchers: Enjoy shopping with vouchers from selected retailers.

Gold Class Tickets: Treat yourself to a luxury cinema experience with Gold Class movie tickets.

Major Event Tickets: Get access to corporate suites at major events like the AFL, Australian Open, or Melbourne Grand Prix.

Referrer Gift Packs: As a token of our appreciation, these gift packs celebrate your ongoing contributions and support as a referral partner.

-

To get started and to set up your payment preferences, please fill out our referrer enrolment form. Once we receive your information, we'll provide you with a referral agreement to sign. After everything is signed and in place, you’ll be able to refer leads to us through our referral hub by using the referrer lead submission form. Alternatively, you can simply introduce us to your client via email. From there, we'll handle the communication with your client directly and initiate the necessary steps. Plus, we’ll keep you updated on the progress of your client’s loan process.

-

As part of our referral partnership, you have access to our marketing resources designed to help you communicate your new asset finance services. Our marketing team is equipped to create customised email and social media templates tailored specifically to your industry and business needs. These tools will enable you to effectively reach out to your client base about our comprehensive asset finance services and car sourcing options. To get started, simply contact our marketing team at marketing@hamerfinance.com.au, and we'll help you set everything in motion!

-

Our partnership-based approach means we focus on our strengths while you focus on yours, effectively managing client relationships. This prevents clients from seeking help elsewhere, maintaining them within our trusted network. Our deep understanding of assets allows us to offer more than just financing—we provide expert advice on the assets themselves, helping clients make well-informed decisions for their personal and business needs.

-

Our car sourcing service is free. We created a dedicated department to ensure clients get the best possible deals on cars, even if their preferred model is out of stock. We negotiate prices, handle paperwork, and offer tailored solutions that fit the client’s budget and needs. We also manage trade-ins, ensuring clients receive the best possible price.

-

While we don’t train people to become asset finance brokers, we do offer personalized asset finance sessions through our "Asset Finance 101 Masterclass." These sessions are tailored to your team’s needs, covering everything from loan structures to real-life client scenarios, helping you effectively manage your clients' financing needs. We also run a "Nurture Program" for ABN holders, providing strategic support to grow your client relationships.

-

No, referring clients to us won’t risk your relationship with them. We aim to support your role by strengthening the services you offer, ensuring you remain their primary contact for all financial needs. We're part of your extended network, helping you manage and enhance your client relationships across all areas of financing.

-

Absolutely, we'll keep you informed at every stage of your client's deal. Here's how our process works:

Lead Submission: Once you submit your client's lead via our online form, we'll notify you by email within 24 hours and reach out to your client.

Discovery Call: We'll quote and complete an application with your client during our initial discovery call. If not, we'll provide them with a quote for consideration.

Quote & Application: Depending on the client's details you provide; we'll get a clear idea of whether we can proceed with the deal.

Pre-Submission: After gathering all necessary documentation with your client, we will prepare for submission to the lender, and you'll be updated via email.

Submission: We submit the deal to the lender, who usually responds with an approval notice within 1-3 business days. We can also source a vehicle for your client if needed.

Approval: Once approved, the deal is handed over to our settlement team. Loan documents are prepared and sent for client signing.

Settlement: When the loan is successfully settled, we'll notify you and provide a loan summary for your records.

At each point, we'll send you updates, typically via email, to ensure you're always in the loop regarding the progress of your client's deal.

We make promoting asset finance easy for you

As a referral partner, you gain access to free marketing tools and support, tailored just for your business and clients, to effectively introduce your new asset finance services. Our marketing team is on hand to develop customised email and social media templates that seamlessly connect with your client base, informing them about our extensive asset finance and car sourcing options. Simply reach out to our marketing team below, and we'll guide you through every step of the way!

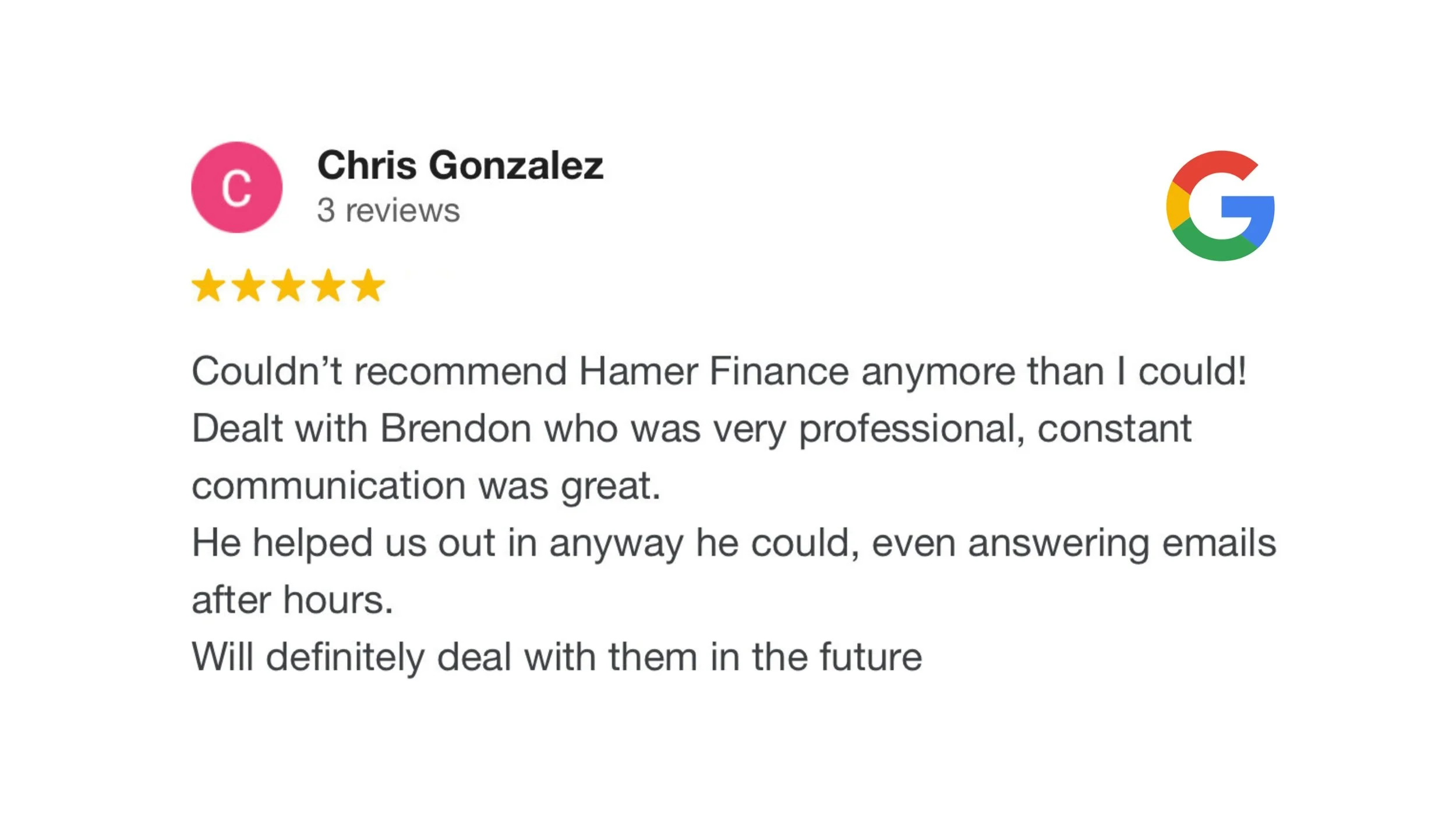

Hear What Our Customers Are Saying